Investing in Silver Coins

Silver coins stand out as a durable, portable, and liquid option for investing in precious metals. Available in various forms, each comes with its own set of advantages and considerations:

Before making a purchase, take these factors into account:

- Spot Price of Silver: Monitor market trends to make informed buying decisions.

- Dealer Reputation: Choose trustworthy sellers with transparent pricing and a good track record.

- Coin Characteristics: Consider weight, purity, design, and potential collector value.

Popular Sovereign Silver Coins:

- American Silver Eagle: First minted in 1986, recognizable design, guaranteed weight, and purity.

- Canadian Silver Maple Leaf: High purity (.9999), beautiful design, with some lower mintage editions commanding higher prices.

- British Silver Britannia: Guaranteed by the Royal UK Mint, recent versions have .999 purity, and some rare editions hold numismatic value.

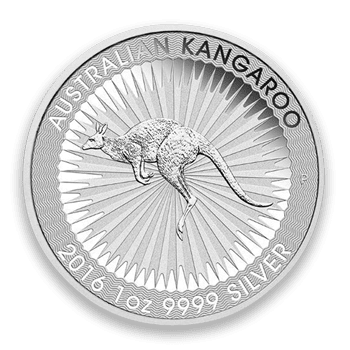

- Australian Perth Mint Silver Koala: Features unique annual designs, .999 pure silver, part of the "Wildlife series."

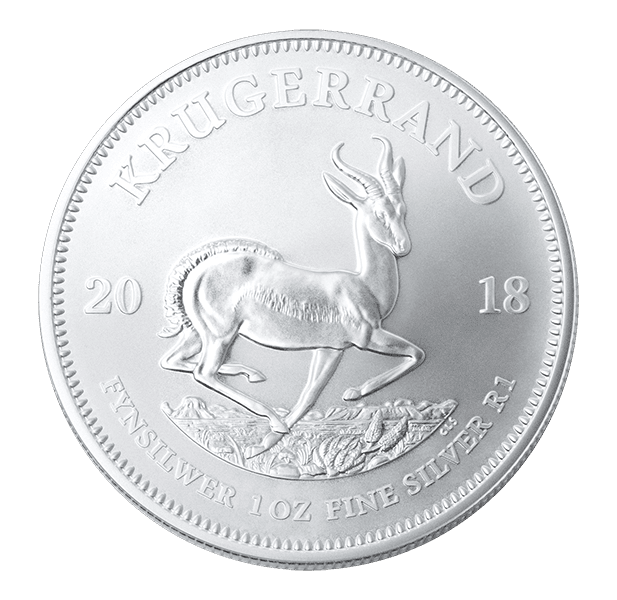

- Silver Krugerrand: South African coin, initially a special edition, now regularly issued, with the same design as the popular Gold Krugerrand.

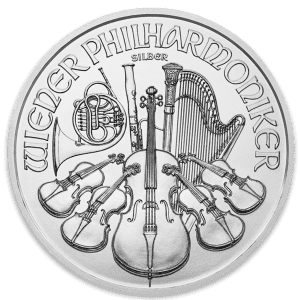

- Austrian Silver Vienna Philharmonic: Culturally significant design, legal tender in Euro, large mintage quantities but still desirable.

Investing in silver coins can be a rewarding endeavor. By staying informed about the market, choosing suitable coins, and dealing with reputable sellers, you can build a valuable collection and hedge against market volatility.

Questions about optimizing your investment portfolio?

Benefit from a complimentary consultation with our experts – call 623-432-3953.

Alternatively, leave us a message on our website, and we'll promptly attend to your inquiries.