Buy Silver Bars Online

As a heralded precious metal, silver bars are cheaper and much more durable than gold. Silver bullion is also a beautiful item to behold.

If you are considering purchasing silver bars, you are in the right place. “Copper State Coin and Bullion” offers the best possible options when looking to buy silver bars online.

Some people invest in stocks. Others invest in tangible items that, over time, will never lose their magic. One option to consider is to buy silver bars online.

Silver bars are called “tangible assets.” In business, this denotes something that only gains value over time and is also something that cannot be lost or displaced.

Silver bars represent so much more than a digital blip on a stock trader’s laptop, and aside from their fiscal value, they represent an exclusive form of ownership that raises your adrenaline!

Many find that when they purchase silver bars, it is almost hard to get rid of them due to their sheer beauty. It is the idea of investing in something that only nature and time can create.

As of 2024, the silver bar price and value is $0.91 per gram, which fluctuates around the clock, and though it may not sound like much, there is a limited amount of silver on this earth.

The only way to replicate silver bullion is to manufacture it synthetically, which a) holds less value and b) defeats the purpose of investing in one of life’s mysteries.

Before you can fully understand the process that leads to buying silver bars online, you must first understand how a silver bar is created.

How Is A Silver Bar Made?

Before we present you with an offer you cannot refuse, it is vital to understand how a silver bar is made. As with most previous metals, silver is extracted from ore.

Ore is a special, mineralized form of rock that contains silver and other precious metals, such as gold, platinum, and copper.

Once mined, the process of crushing and grinding the ore so that it is easier to separate silver particles occurs. In many cases, silver - much like gold - is found in small bits outside the ore.

This process involves a strainer and water.

Next, the silver is heated through a process called: “smelting,” where over 1,800 degrees of heat finalizes the separation of the silver from the ore.

Once separated, it is refined to its purest form, typically 99.9%, and the rest is rather simple. The silver is melted and poured into a cast or a mold to create its unique bar shape.

Upon hardening from molten to physical form, you are left with a silver bar.

What Does “Purity” Mean?

Purity is simply the concentration of silver compared to other assets. The most common is 99.9%, indicating that only 0.01% contains traces of other materials.

This is an essential process for investors and collectors because it determines how pure the silver is. This strongly dictates its value, as the more pure it is, the more it is worth.

Silver's purity is determined through several techniques, including alloy composition testing, hallmarking, and assay testing. Though not the most exciting topic, it is worth notation.

Hallmarking and stamping are commonly used to determine the purity and authenticity of silver. It looks for microscopic marks and imperfections that indicate any traces of impurities.

Assay testing is a more advanced technique that utilizes fluorescence analysis (or a fancy way of saying that instead of looking through a magnifying glass, technology does it for you).

It is rare to encounter silver with more than a few percentage points of other alloys or metals, but it is worth testing your silver. Here at Copper State Coin and Bullion, we guarantee 99.% purity.

Investing In Silver Bars

In its own right, buying silver bars allows investors to put their money into an asset so much more pleasant to look at or to hold than a stock certificate.

When you purchase silver bars, you are acquiring something that is in limited supply, and no matter what it is worth, it has a story.

This means that though the value of silver may fluctuate over time, it is immune to economic effects. When you invest in silver bars, you are investing in a cornerstone of history.

You are really investing in something that has an immense history. As a precious metal, when you buy pure silver bars, you are putting your money into something that is in limited supply.

Aside from monetary value, there is a second piece of the puzzle to consider. Picture holding a silver bar in your hands, knowing that this was something created by something amazing: time.

Unlike stocks, crypto, or even an antique painting, when you buy pure silver bars, you are buying a piece of the earth itself and thousands of years of processes we have yet to garner.

Thus, there is no denying that most invest in silver bars for monetary incentives, which is also very beneficial. The price of silver fluctuates in a different direction from stocks.

Stocks use the company’s success to determine its value. Silver (as well as gold and other precious metals) changes based on supply and demand, making it more versatile.

This allows for pricing efficiency, liquidity, and portfolio diversification. In fact, in recent years, many investors have turned to investing in silver bars for purchase and trade.

Factors Behind Pricing And Value

There are a number of factors that contribute to the value and pricing of a silver bar. One we discussed already: when you want to buy silver bars, purity is taken into account.

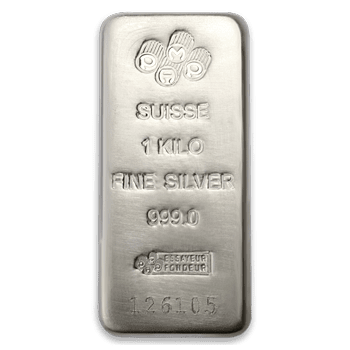

Another factor is density or weight. This is relatively simple: a 1-gram silver bar will cost a lot less than 1 kilogram. As a general rule, larger bars contain more silver, thus raising its value.

Lastly, as discussed, market demand and supply can cause daily fluctuations. This is not strictly employed in silver. Like any commodity, the value of silver bars depends on purchase intent.

In other words, the more silver needed, the higher the price. Other factors include economic fluctuations, geopolitical events, industrial demand, and the manufacturer's credibility.

Types Of Silver Bars

There are different types of silver bars. One is called an investment-grade bar, which refineries produce solely for monetary investment.

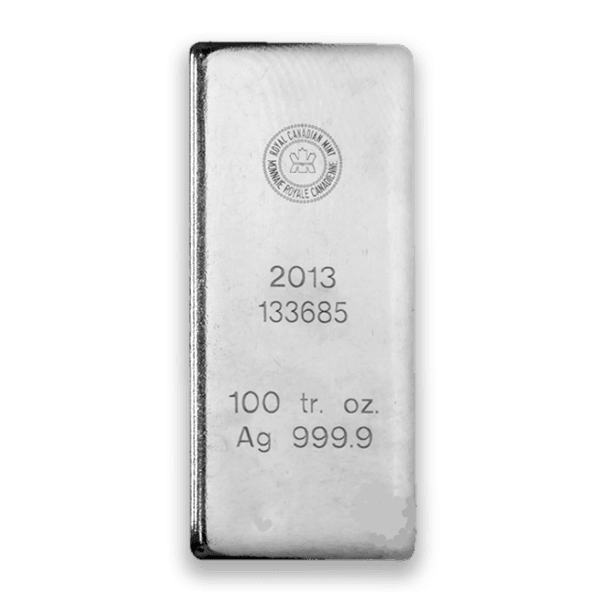

These can come in a range of sizes, from 1 gram to 1 kilogram. This type of silver bar comes with a stamp to indicate its authenticity, purity, and weight.

Another form of silver bars is called “poured bars,” which are more of a collector’s item, prized by enthusiasts for their unique aesthetic.

Third, there are cast bars, which we discussed earlier. This is when molten silver is poured into a pre-made mold or cast and then cooled until it is hardened to match the shape of the mold.

The last type we will discuss is a vintage or collectible bar, which is very similar to a poured bar, except it may hold more than just rarity.

Often, these have some historical significance and may have a story behind them. Keep in mind that most gold was mined during the Gold Rush, and just like gold, silver has its own tale.

The Story You Are Buying

When you buy silver bars, there is a chance that they were recently mined and replicated. However, the primary determinant of value is history.

First, the Comstock Lode of 1859 was a historical moment when a passerby stumbled onto a Nevada-based location. They found high silver deposits, which led to a silver rush.

Another event was the Panic of 1893, which occurred during the Great Depression in the United States. However, not many are aware that during this period, there was panic.

Why?

Well, one of the factors behind the economic collapse was the Silver Boom of the 1870s and 1880s. An oversupply of silver played a significant role in The Great Depression!

Things To Consider When Buying

Now that we have covered the basics, one last item remains: can you trust the seller?

When you buy silver bars, there are dozens of aspects to consider that will allow you to make a wise and safe investment or purchase.

To start, only buy from a company that prioritizes its reputation. This means that the silver bar is not only of high purity but is also of a valid form.

Like false gold, silver can be replicated, and you must ensure the source you buy silver bars from is trusted. This means they can provide proof of ownership.

Another thing to consider is accreditation and proof of authenticity, usually through membership in specific organizations that exist to ensure regulatory purposes.

These include the American Exploration and Mining Association, the International Precious Metals Institute, and the National Mining Association.

Lastly, a rule of thumb is if the seller is unable or willing to provide information on a) the source of the silver bar or b) specific information on when and where it was manufactured.

In the end, trust your gut.

Do You Want To Buy Silver Bars Online?

Here at Copper State Coin and Bullion, we pride ourselves in providing a diverse range of silver bars, among many other items. If you are interested in investing in precious metal, or want to discuss pricing, please feel free to reach out to us on our contact page, and we will be in touch.